last highlighted date: 2024-11-12

Highlights

- If you fell asleep in 1945 and woke up in 2018 you would not recognize the world around you

- And if you tried to think of a reasonable narrative of how it all happened, my guess is you’d be totally wrong. Because it isn’t intuitive, and it wasn’t foreseeable 73 years ago.

- Sixteen million Americans – 11% of the population – served in the war. About eight million were overseas at the end. Their average age was 23. Within 18 months all but 1.5 million of them would be home and out of uniform.

- Where were they going to live?

- Those were the most important questions of the day, for two reasons. One, no one knew the answers. Two, if it couldn’t be answered quickly, the most likely scenario – in the eyes of many economists – was that the economy would slip back into the depths of the Great Depression.

- Housing construction ground to a halt, as virtually all production capacity was shifted to building war supplies

- It was unclear where soldiers could work.

- In 1946 the Council of Economic Advisors delivered a report to President Truman warning of “a full-scale depression some time in the next one to four years.”

- urope and Japan – sat in ruins dealing with humanitarian crises. And America itself was buried in more debt than ever before, limiting direct government stimulus.

-

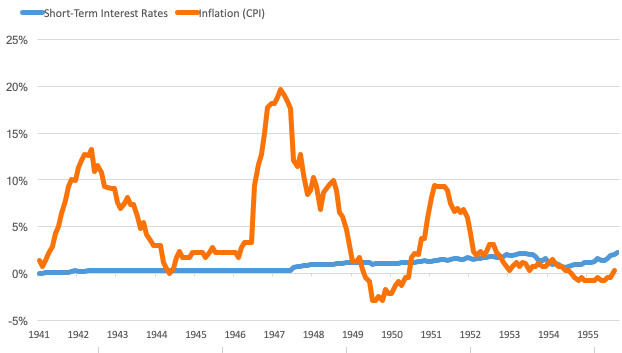

- So we did something about it: Low interest rates and the intentional birth of the American consumer.

- The Federal Reserve was not politically independent before 1951. The president and the Fed could coordinate policy.

- Consumption became an explicit economic strategy in the years after World War II.

- An era of encouraging thrift and saving to fund the war quickly turned into an era of actively promoting spending. Princeton historian Sheldon Garon writes:

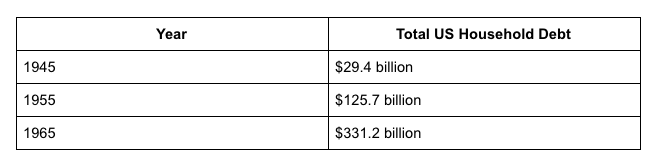

- One was the GI Bill, which offered unprecedented mortgage opportunities. Sixteen million veterans could buy a home often with no money down, no interest in the first year, and fixed rates so low that monthly mortgage payments could be lower than a rental.

- The second was an explosion of consumer credit

- And interest on all debt, including credit cards, was tax deductible at the time.

- The 1930s were the hardest economic decade in American history. But there was a silver lining that took two decades to notice: By necessity, the Great Depression had supercharged resourcefulness, productivity, and innovation.

- Then the 1950s came around and we suddenly realized, “Wow, we have some amazing new inventions. And we’re really good at making them.”

- Appliances, cars, phones, air conditioning, electricity.

- Commercial car and truck manufacturing virtually ceased from 1942 to 1945. Then 21.4 million cars were sold from 1945 to 1949. Another 37 million were sold by 1955.

- 1.9 million homes were built from 1940 to 1945. Then 7 million were built from 1945 to 1950. Another 8 million were built by 1955.

- The defining characteristic of economics in the 1950s is that the country got rich by making the poor less poor.

- As for the top one percent, the really well-to-do and the rich, whom we might classify very roughly indeed as the $16,000-and-over group, their share of the total national income, after taxes, had come down by 1945 from 13 percent to 7 percent.

- The leveling out of classes meant a leveling out of lifestyles. Normal people drove Chevys. Rich people drove Cadillacs. TV and radio equalized the entertainment and culture people enjoyed regardless of class. Mail-order catalogs equalized the clothes people wore and the goods they bought regardless of where they lived. Harper’s Magazine noted in 1957:

- 1973 was the first year where it became clear the economy was walking down a new path.

- And you have to put all of that in the context of how much fear there was between Vietnam, riots, and the assassinations of Martin Luther King, John and Bobby Kennedy.

- America dominated the world economy in the two decades after the war. Many of the largest countries had their manufacturing capacity bombed into rubble. But as the 1970s emerged, that changed. Japan was booming. China’s economy was opening up. The Middle East was flexing its oil muscles.

- Ronald Reagan’s 1984 Morning in America ad declared:

- It’s morning again in America. Today more men and women will go to work than ever before in our country’s history. With interest rates at about half the record highs of 1980, nearly 2,000 families today will buy new homes, more than at any time in the past four years. This afternoon 6,500 young men and women will be married, and with inflation at less than half of what it was just four years ago, they can look forward with confidence to the future.

- President Clinton boasted in his 2000 State of the Union speech:

- We begin the new century with over 20 million new jobs; the fastest economic growth in more than 30 years; the lowest unemployment rates in 30 years; the lowest poverty rates in 20 years; the lowest African-American and Hispanic unemployment rates on record; the first back-to-back surpluses in 42 years; and next month, America will achieve the longest period of economic growth in our entire history. We have built a new economy.

- Between 1993 and 2012, the top 1 percent saw their incomes grow 86.1 percent, while the bottom 99 percent saw just 6.6 percent growth.

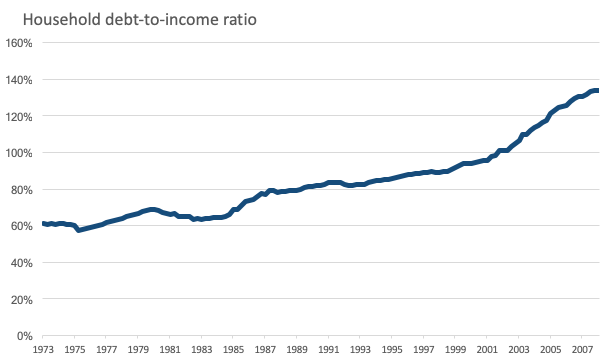

- All that matters is that sharp inequality became a force over the last 35 years, and it happened during a period where, culturally, Americans held onto two ideas rooted in the post-WW2 economy: That you should live a lifestyle similar to most other Americans, and that taking on debt to finance that lifestyle is acceptable.

- So what does Peter do?

- He takes out a huge mortgage. He has $45,000 of credit card debt. He leases two cars. His kids will graduate with heavy student loans. He can’t afford the stuff Joe can, but he’s pushed to stretch for the same lifestyle. It is a big stretch.

- During a time when median wages were flat, the median new American home grew 50% larger:

- Household debt-to-income stayed about flat from 1963 to 1973. Then it climbed, and climbed, and climbed:

- Economist Hyman Minsky described the beginning of debt crises: The moment when people take on more debt than they can service. It’s an ugly, painful moment. It’s like Wile E. Coyote looking down, realizing he’s screwed, and falling precipitously.

- The Fed backstopped corporate debt in 2008. That helped those who owned their debt – mostly rich people.

- Economist Bhashkar Mazumder has shown that incomes among brothers are more correlated than height or weight. If you are rich and tall, your brother is more likely to also be rich than he is tall.

- But they’re symptomatic of the bigger thing that’s happened since the early 1980s: The economy works better for some people than others. Success isn’t as meritocratic as it used to be and, when success is granted, is rewarded with higher gains than in previous era

-

- The Tea Party, Occupy Wall Street, Brexit, and the rise of Donald Trump each represents a group shouting, “Stop the ride, I want off.”